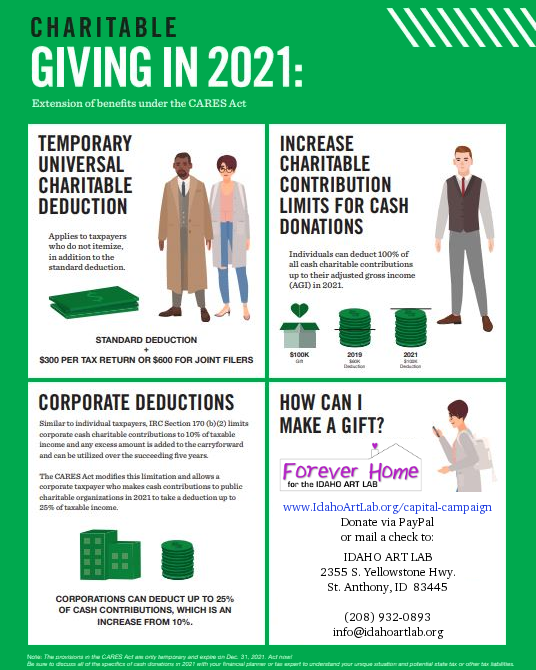

Charitable Giving in 2021

Extension of benefits under the CARES Act

Temporary universal charitable deduction:

For those who do not itemize on their 2021 tax return, in addition to the standard deduction you may claim up to a $300 deduction ($600 for joint filers) for charitable donations.

Why let that $300 go to the government to spend how they want? Donate to the Idaho Art Lab now and YOU choose where your tax dollars go.

Increase to the charitable contribution limits for cash donations:

For those who will itemize on their 2021 tax return, individuals can deduct 100% of all cash charitable contributions up to their adjusted gross income in 2021.

Corporate Deductions now up to 25% of taxable income:

Similar to individual taxpayers, IRC Section 170(b)(2) limits corporate cash charitable contributions to 10% of taxable income and any excess amount is added to the carryforward and can be utilized over the succeeding five years.

The CARES Act modifies this limitation in 2021 and allows a corporate taxpayer who makes cash contributions to public charitable organizations, like Idaho Art Lab, to take a deduction up to 25% of taxable income.

How can I make a gift to the

FOREVER HOME Capital Campaign for the Idaho Art Lab?

Go to www.IdahoArtLab.org/capital-campaign and donate online

Or mail a check to:

IDAHO ART LAB

2355 S. Yellowstone Hwy.

St. Anthony, ID 83440

Contact us with questions at (208) 932-0893 or info@idahoartlab.org